Additional China tariffs on imported goods, the so-called section 301 tariffs, are collected under Section 301 of the Trade Act of 1974 and amounted to $29 billion in fiscal year 2019.

The Duty Explorer app reduces your work from hundreds of pages of U.S. regulations on tariffs down to a few lines. We remove the haystack, revealing just the needles. Consequently, your time needed to process these tariffs goes from hours and minutes to seconds, while you greatly reduce mistakes. Furthermore, it is very easy to learn and use and pays for itself in no time.

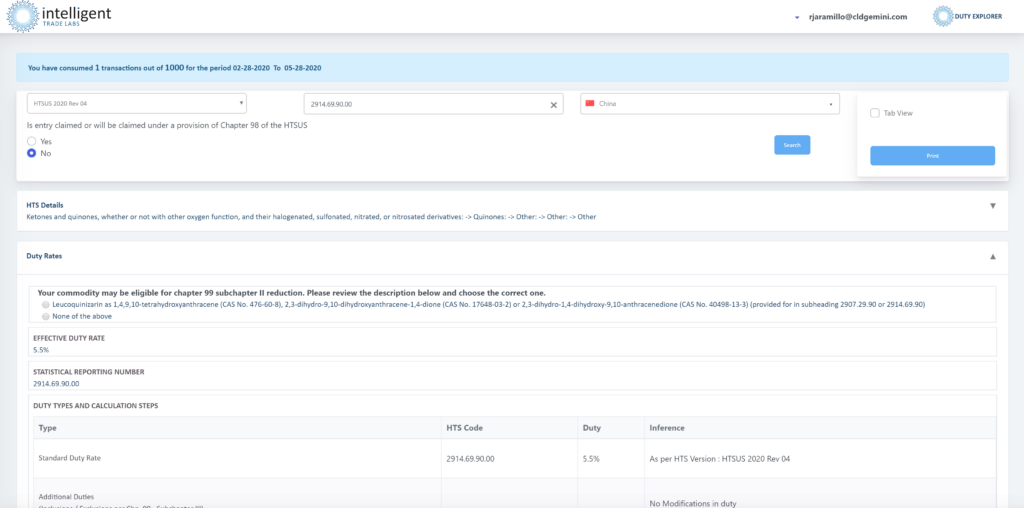

To use the Duty Explorer, all you need to do is enter the 10-digit HTSUS code and the country of origin. Then all Section 301 issues related to that HTSUS code will appear in a few lines. Then you make a few simple selections based on your import transaction, and you’re done.

Section 301 China Tariffs

In 2018, the U.S. slapped so-called Section 301 tariffs on certain goods imported from China. Significantly, a Section 301 tariff results when … an act, policy, or practice of a foreign country violates, or is inconsistent with, the provisions of, or otherwise denies benefits to the United States under, any trade agreement or is unjustifiable and burdens or restricts U.S. commerce …

As a result, the additional China tariffs on imported goods amounted to $29 billion in fiscal year 2019.

The lists of the products covered by Section 301 tariffs on goods from China have been released in the form of updates in a U.S. government publication called the Harmonized Tariff Schedule of the US, known by the acronym HTSUS.

China Exclusions

Similarly, certain products have been excluded from these lists. The problem is that the user must search 45 different notes in the HTSUS covering 130 pages and many thousands of 10-digit HTSUS codes covering many thousands of product descriptions to find if their product is included or excluded and this is time consuming and confusing.

Furthermore, the U.S. government keeps issuing more updates and decides whether to extend or curtail these exclusions after 1 year. The Section 301 exclusions are further complicated because the U.S. government made them retroactive, so the app instantaneously gives the user the effective date, the date of retro-activity, and the date until the exclusion expires. This is vital information and using the Duty Explorer, this information is provided instantaneously. Mistakes in this area can mean a difference in tariff rates of 25%.

EU Section 301 Tariffs

In addition, in 2019 the World Trade Organization ruled against certain European Union (EU) countries in favor of the U.S. related to subsidies for Airbus. Due to this ruling, the U.S. implemented Section 301 tariffs against certain EU goods. In short, the Duty Explorer also processes transactions covered by these EU Section 301 tariffs in seconds.

DUTY EXPLORER FEATURES AND BENEFITS

ITL has simplified the process into an application whereby the user enters the 10-digit HTSUS code and the country of origin as China or EU country. With this minimal information the user can determine the inclusions and exclusions in seconds, saving considerable time.

Watch the 3-minute app demo video below:

Exemptions

The app does a lot more. Exemptions are retroactive, so the app instantaneously gives the user the effective date, the date of retro-activity, and the date until the exemption expires. As a result, instead of reviewing dozens of different lists of exemptions spread out over 130 pages, all exemptions related to your import are consolidated into one concise space of a few lines.

Handling Chapter 98 Issues

The regulations also include special mechanisms for handling provisions under certain parts of Chapter 98, which are complex. Under these circumstances, the app assists the user in processing in a way that simplifies these complex processes.

Temporary Reduction in Tariffs

Any products covered by the section 301 tariffs on goods entering the US from China and other countries may be eligible for temporary reduction in rates of duty, per Subchapter II of Chapter 99. The list of these temporary reductions runs 160 pages, making the process tedious. The app lists any possible temporary reductions in seconds.

Audit Trail

When the user has completed processing a transaction, the app generates an audit trail listing all the pertinent data. This can be saved for record keeping or sent as a PDF to other parties within or outside your organization. Above all, the audit trail is designed to withstand CBP scrutiny under their reasonable care standards, a type of due diligence.

Statistical Reporting Codes

Part of the audit trail contains the statistical reporting codes required for every entry into the USA. Due to different circumstances, codes from Chapters 1 through 97, and chapter 98, and/or Chapter 99 of the HTSUS might be required. Regardless, the app generates all the correct tariff codes in the appropriate order for filing with the US government. Moreover, this is ideal for those processing import entries because it saves time and prevents errors. Significantly, errors can be subject to fines and penalties.

Users

The app is an ideal productivity tool for purchasing departments, identifying which duties to include as part of landed cost calculations. Get these calculations wrong and one can underestimate or overestimate costs, leading to expensive ramifications.

Whether you’re in planning, purchasing, regulatory compliance, or processing entries into the US from China, the Duty Explorer is the must-have tool to save you time and money while reducing risks of mistakes and giving you the assurances of a solid audit trail for record keeping.